EDEN PRAIRIE, Minn.–(BUSINESS WIRE)– Agiliti Inc. (NYSE: AGTI) (“Agiliti”), a nationwide provider of healthcare technology management and service solutions to the United States healthcare industry, today announced its financial results for the first quarter ended March 31, 2023, and reaffirmed its financial outlook for 2023.

First Quarter 2023 Highlights

- Revenue growth of 1.9% to $300 million

- Net income of $3 million, down $16.9 million from the prior year period; diluted income per share of $0.02, down $0.12 per share from the prior year period

- Adjusted EBITDA1 of $72 million, compared to $89 million in the prior year period; Adjusted Earnings Per Share1 of $0.20, down $0.09 compared to the prior year period

“Our first quarter performance met our expectations with results that reflect the importance of our value proposition,” said Tom Boehning, Chief Executive Officer. “Our customers are navigating a broad set of economic challenges, and we are proud to bring solutions that address many of the financial, clinical and operational constraints facing our healthcare system today. This critical work continues to drive the momentum in our business and gives us confidence in our outlook for the year.”

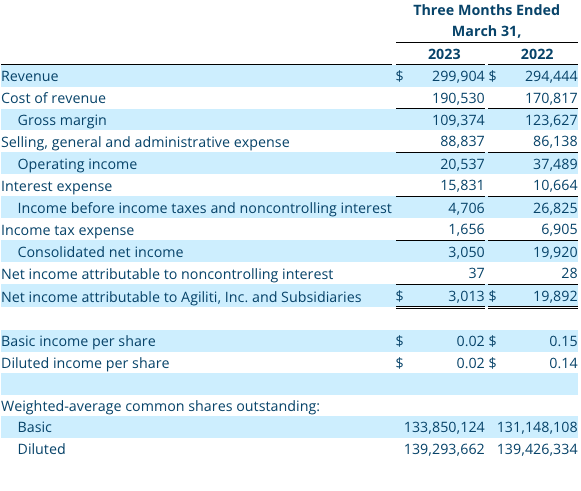

First Quarter 2023 Financial Results

Total revenue for the three months ended March 31, 2023, was $299.9 million, representing a 1.9 percent increase from total revenue of $294.4 million for the same period of 2022.

Net income for the three months ended March 31, 2023, was $3.0 million, compared to $19.9 million for the same period of 2022.

Adjusted EBITDA1 for the three months ended March 31, 2023, was $72.0 million, a 19.3 percent decrease from Adjusted EBITDA1 of $89.2 million for the same period of 2022.

2023 Financial Outlook

The company reaffirmed its guidance for 2023 as follows:

- Revenue of $1.16 – $1.19 billion

- Adjusted EBITDA of $295 – $305 million2

- Adjusted earnings per share of $0.65 – $0.70 per share2

- Capex investment expected in the range of $85 to $95 million

Conference Call Information

Agiliti will hold a conference call to discuss its first quarter 2023 results on Tuesday, May 9, at 5 p.m. Eastern Time (4 p.m. Central Time).

The conference call can be accessed live over the phone by dialing 1-877-407-0792 or for international callers, 1-201-689-8263. The passcode for the live call and the replay is 13737749. A replay will be available two hours after the call and can be accessed by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The Access ID for the replay call is 13737749. The replay will be available until May 16, 2023.

About Agiliti

Agiliti is an essential service provider to the U.S. healthcare industry with solutions that help support a more efficient, safe and sustainable healthcare delivery system. Agiliti serves more than 10,000 national, regional and local acute care and alternate site providers across the U.S. For more than eight decades, Agiliti has delivered medical equipment management and service solutions that help healthcare providers reduce costs, increase operating efficiencies and support optimal patient outcomes.

Forward-Looking Statements

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Certain statements in this press release are forward-looking in time, including financial outlook and other preliminary results, and involve risks and uncertainties. The following factors, among others, could adversely affect our business, operations and financial condition causing our actual results to differ materially from those expressed in any forward-looking statements: negative reaction of our investors, our suppliers, our customers or our employees to our leadership succession; market volatility of our common stock as a result of our leadership succession; the risk that the leadership succession may not provide the results that the company expects; our history of net losses and substantial interest expense; our need for substantial cash to operate and expand our business as planned; our substantial outstanding debt and debt service obligations; restrictions imposed by the terms of our debt; a decrease in the number of patients our customers are serving; our ability to effect change in the manner in which health care providers traditionally procure medical equipment; the absence of long-term commitments with customers; our potential inability to maintain the agreement with the U.S. Department of Health and Human Services’ (“HHS”) and Office of Assistant Secretary of Preparedness and Response (“ASPR”) (the “Agreement”) or comply with its terms and risks relating to extension, renewal or termination of the Agreement or any of our existing contacts with HHS and ASPR; our ability to renew contracts with group purchasing organizations and integrated delivery networks; changes in reimbursement rates and policies by third-party payors; the impact of health care reform initiatives; the impact of significant regulation of the health care industry and the need to comply with those regulations; the effect of prolonged negative changes in domestic and global economic conditions; difficulties or delays in our continued expansion into certain of our businesses/geographic markets and developments of new businesses/geographic markets; additional credit risks in increasing business with home care providers and nursing homes, impacts of equipment product recalls or obsolescence; increases in vendor costs that cannot be passed through to our customers; and other Risk Factors as detailed in our most recent annual report on Form 10-K.

Agiliti, Inc. and Subsidiaries

Consolidated Statements of Operations

(in thousands, except share and per share information)

(unaudited)

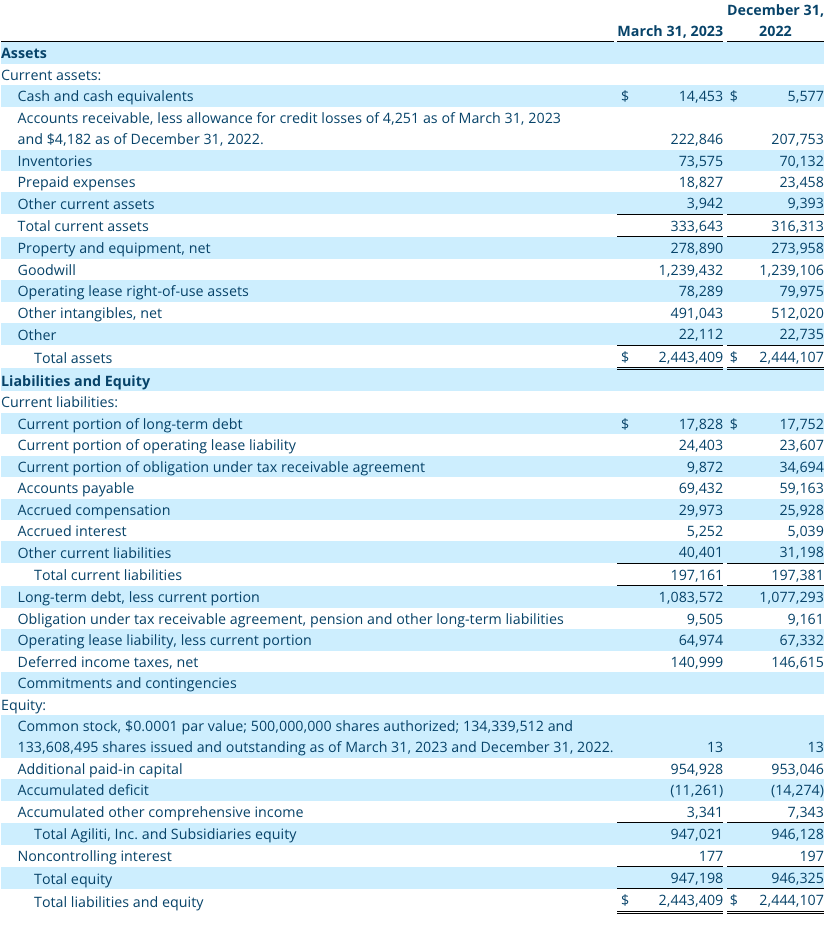

Agiliti, Inc. and Subsidiaries

Consolidated Balance Sheets

(in thousands, except share and per share information)

(unaudited)

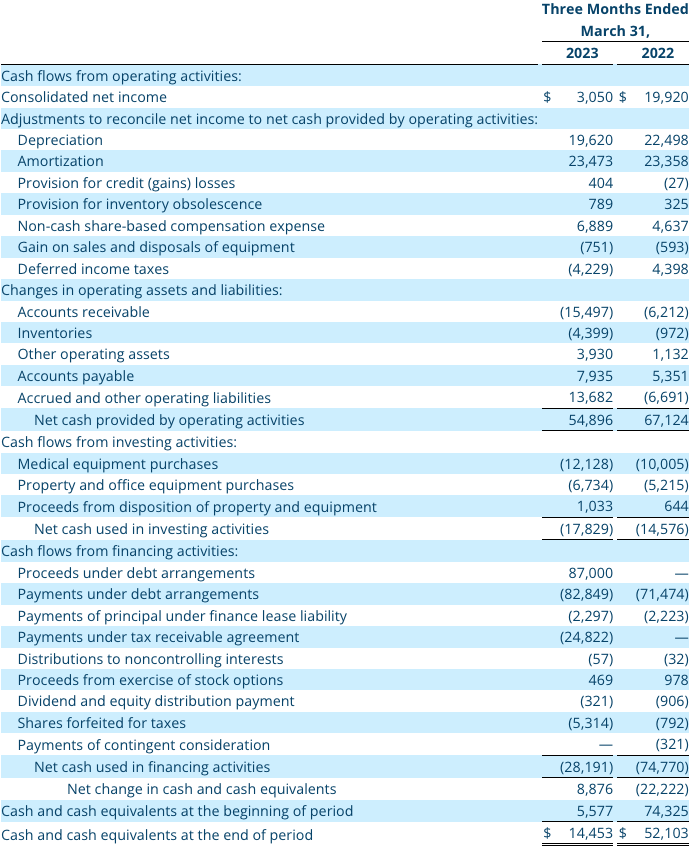

Agiliti, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

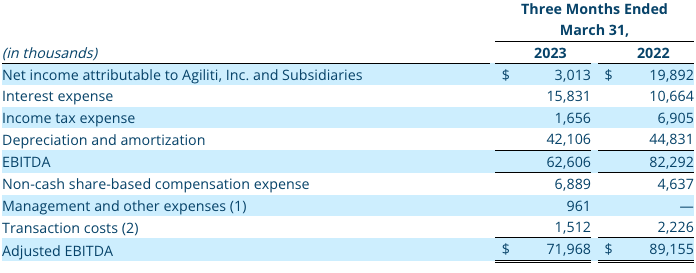

Use of non-GAAP information

This press release contains non-GAAP measures, including EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Net Debt and Net Leverage Ratio. We use these internally as measures of operational performance, or liquidity, as applicable, and disclose them externally to assist analysts, investors and lenders in their comparisons of operational performance, valuation and debt capacity across companies with differing capital, tax and legal structures. We believe the investment community frequently uses these measures in the evaluation of similarly situated companies. Adjusted EBITDA is also used by the Company as a factor to determine the total amount of incentive compensation to be awarded to executive officers and other employees. EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Net Debt and Net Leverage Ratio, however, are not measures of financial performance under accounting principles generally accepted in the United States of America (“GAAP”) and should not be considered as alternatives to, or more meaningful than, net income as measures of operating performance or to cash flows from operating, investing or financing activities or to total debt as measures of liquidity or debt capacity. Since EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Net Debt and Net Leverage Ratio are not measures determined in accordance with GAAP and are thus susceptible to varying interpretations and calculations, these measures, as presented, may not be comparable to other similarly titled measures of other companies. EBITDA, Adjusted EBITDA, and Adjusted Net Income do not represent amounts of funds that are available for management’s discretionary use. EBITDA and Adjusted EBITDA presented may not be the same as EBITDA and Adjusted EBITDA calculations as defined in the First Lien Credit Facilities. EBITDA is defined as earnings attributable to Agiliti, Inc. before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA excluding non-cash share-based compensation expense, management fees and other non-recurring gains, expenses, or losses, transaction costs, remeasurement of the tax receivable agreement and loss on extinguishment of debt. LTM Adjusted EBITDA represents the last twelve months (“LTM”) of Adjusted EBITDA.

Agiliti, Inc. and Subsidiaries

Non-GAAP Financial Measure: Adjusted EBITDA

______________________________

(1) Management and other expenses represent non-recurring expenses.

(2) Transaction costs represent costs associated with potential and completed mergers and acquisitions.

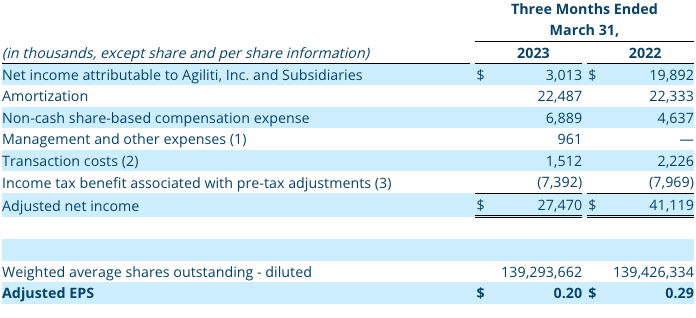

Agiliti, Inc. and Subsidiaries

Non-GAAP Financial Measure: Adjusted Net Income and Adjusted EPS

______________________________

(1) Management and other expenses represent non-recurring expenses.

(2) Transaction costs represent costs associated with potential and completed mergers and acquisitions.

(3) Income tax benefit associated with pre-tax adjustments represents the tax benefit or provision

associated with the reconciling items between net income and Adjusted Net Income and includes both

the current and deferred income tax impact of the adjustments. To determine the aggregate tax effect

of the reconciling items, we utilized statutory income tax rates ranging from 0% to 26%, depending

upon the applicable jurisdictions of each adjustment.

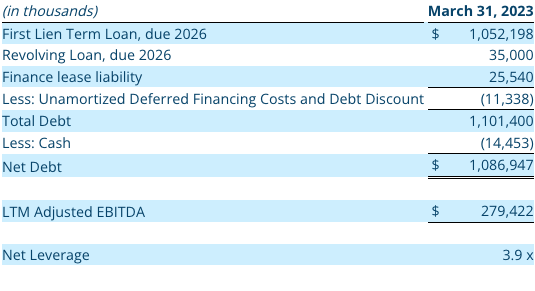

Agiliti, Inc. and Subsidiaries

Non-GAAP Financial Measure: Net Debt and Net Leverage Ratio

_________________________

1 Non-GAAP Measures. See further discussion on page 6

2 With regard to the non-GAAP Adjusted EBITDA guidance and adjusted earnings per share guidance provided above, a reconciliation to GAAP net income has not been provided as the quantification of certain items included in the calculation of GAAP net income cannot be calculated or predicted at this time without unreasonable efforts. For example, the non-GAAP adjustment for stock-based compensation expense requires additional inputs such as number of shares granted and market price that are not currently ascertainable, and the non-GAAP adjustment for certain reserves and expenses depends on the timing and magnitude of these expenses and cannot be accurately forecasted. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could have a potentially unpredictable, and potentially significant, impact on its future GAAP financial results. See further discussion below regarding historical Adjusted EBITDA and historical adjusted earnings per share.